Demystifying the Operating Result Formula

The operating result, also known as operating profit, is a key indicator of your business's core profitability. It shows the profit generated from primary business activities, excluding interest and taxes. This focus makes it a powerful tool for evaluating the health and efficiency of your business model.

Imagine two businesses with identical revenue but different operating results. The business with the higher operating result is managing its resources more effectively. This efficiency can lead to greater stability during tough economic times and a stronger platform for future expansion.

Why Your Revenue Isn't the Whole Story

Many businesses focus heavily on revenue, celebrating growth while potentially overlooking underlying inefficiencies. Revenue alone doesn't provide a complete picture of financial health. It's possible to have high revenue but still lose money if operating expenses are too high. The operating result formula provides a clearer view of your core business's profitability. Focusing on optimizing your operating result helps build a sustainable and profitable business.

Understanding the Operating Result Formula

Calculating this vital metric is straightforward. The operating result formula is:

Operating Result = Revenue – Operating Expenses

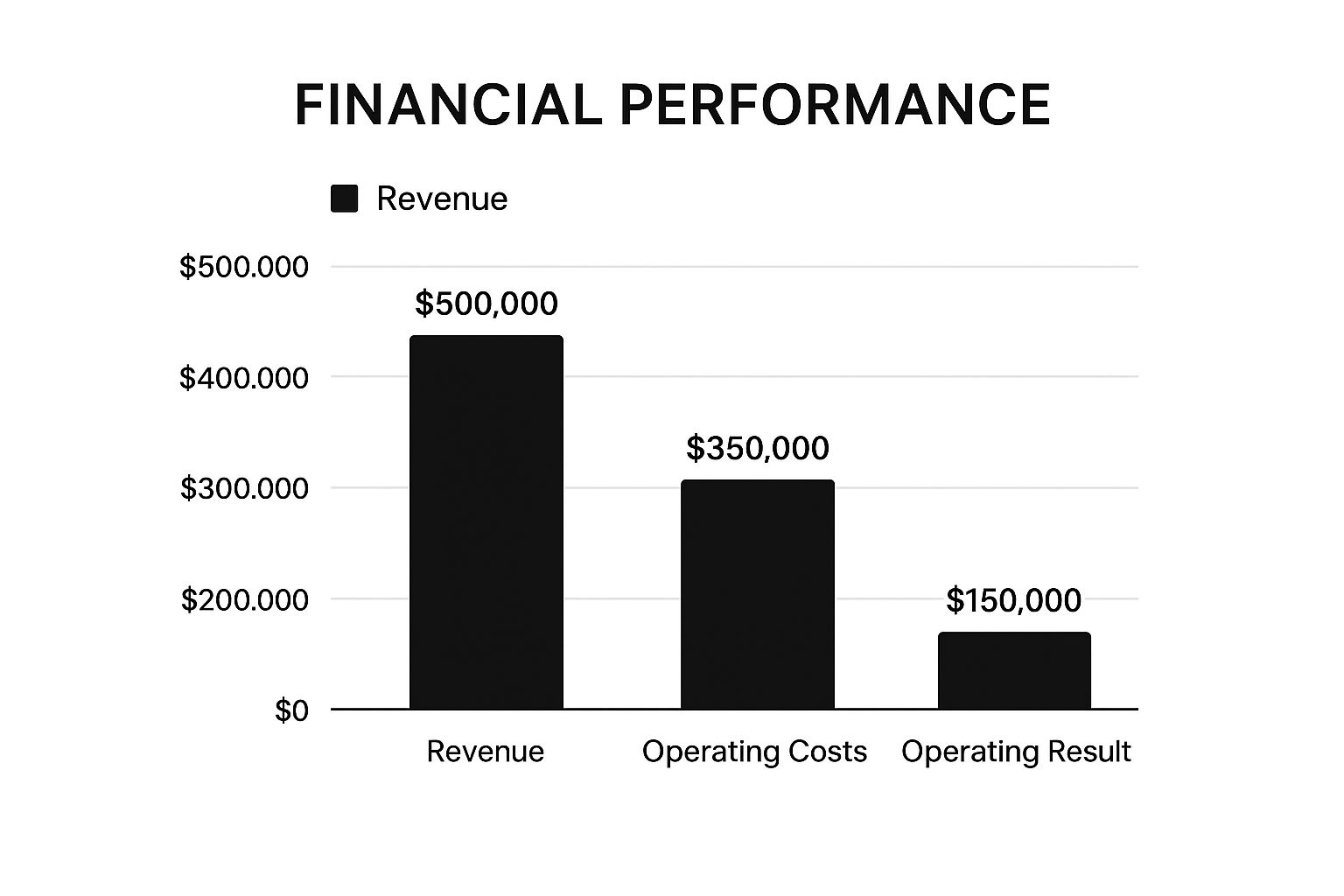

This simple equation is powerful. Understanding it is crucial for assessing financial health. In the UK, calculating operating profit involves subtracting operating expenses from revenue. For example, a UK retail business with £500,000 in revenue and £380,000 in operating expenses has an operating profit of £120,000. This calculation helps businesses, particularly in the UK retail sector, assess their core performance without external factors like interest or taxes.

Analyzing these metrics helps UK companies streamline operations and boost profitability. A 10% increase in operating expenses could significantly impact profits, highlighting the importance of expense management. UK companies often use financial software like Sage and advisors to optimize their financial models and remain competitive. For a deeper dive into operating profit calculations, find more detailed statistics here.

Applying the Formula in Different Business Contexts

Different businesses use the operating result formula in various ways. A startup might use it to track progress toward profitability and secure funding. A larger company might use it to benchmark performance against competitors and identify areas for improvement. Regardless of size, the operating result provides valuable insights into the health and efficiency of operations. This underlying profitability attracts investors, secures loans, and helps businesses withstand economic challenges. This understanding empowers businesses to make informed decisions that drive sustainable growth and long-term success.

Calculate Operating Profit Like a Financial Pro

Calculating your operating profit doesn't have to be intimidating. This section offers a clear method for calculating your operating profit, empowering you to accurately assess your business's performance. We'll break down the crucial parts of the operating result formula, highlighting common mistakes and clarifying what should and shouldn't be included in your calculations.

Understanding the Formula's Components

The operating result formula is straightforward: Operating Result = Revenue – Operating Expenses. However, its accurate application requires a nuanced understanding of each component. This is where many business owners, even experienced ones, can encounter challenges.

-

Revenue: This encompasses all income derived from your core business operations. For a TikTok Shop seller, this would be the sales revenue from products sold.

-

Operating Expenses: These are the costs directly tied to running your business. Examples include the cost of goods sold (COGS), marketing expenses, salaries, and rent.

Let's illustrate with a simple example. If your TikTok shop generates £100,000 in revenue and your operating expenses total £60,000, your operating profit is £40,000. This represents a 40% profit margin – meaning for every pound earned, £0.40 is profit after operating costs are covered.

Identifying and Avoiding Common Errors

A frequent mistake is incorporating non-operating income or expenses into the calculation. Interest income from investments or a one-time gain from selling an asset should not be included in revenue. Likewise, interest payments on loans should be excluded from operating expenses. These items belong in other sections of your financial statements.

Another potential issue is the misclassification of expenses. A marketing campaign cost might be incorrectly categorized as an administrative expense, distorting your results. Accurate and consistent expense categorization is essential for meaningful analysis, allowing you to track trends and make well-informed business decisions.

To help clarify these components, let's examine a breakdown in the table below:

Operating Result Formula Components Breakdown

This table breaks down each element that goes into the operating result formula calculation

| Component | Definition | What to Include | What to Exclude |

|---|---|---|---|

| Revenue | Income generated from core business operations | Sales of goods or services, subscription fees | Investment income, asset sales |

| Operating Expenses | Costs directly associated with running the business | COGS, marketing, salaries, rent, utilities | Interest payments, taxes, one-time expenses |

This table summarizes the key components of the operating result formula and provides guidance on proper categorization. Accurate classification ensures a true reflection of your operating performance.

Adapting the Formula for Different Business Models

While the basic operating result formula remains consistent, the specific revenue streams and operating expenses will differ depending on the business model. A service-based business might include consulting fees as revenue and travel expenses as operating expenses. You might also be interested in learning more about managing your TikTok Shop financials: How to master your TikTok Shop Financials using Mergoio.

Seasonal businesses need particular consideration. When comparing operating profit month-to-month, it's important to account for seasonal variations. A Christmas decoration shop will likely see a spike in revenue and expenses in November and December compared to slower months like January or February.

By understanding the nuances of the operating result formula, you can accurately analyze your business's performance and make informed strategic decisions. Comparing your results to industry benchmarks can provide further insights into your financial standing.

Mastering Operating Profit Margin Benchmarks

While understanding your operating profit is crucial, it's the operating profit margin that truly reveals your business's financial health. This key metric expresses operating profit as a percentage of revenue, enabling meaningful comparisons across time, against competitors, and within your specific industry. Essentially, it shows how effectively your business generates profit from its core operations. This section explores how benchmarking your operating profit margin can inform strategic decision-making and how industry averages provide valuable context for assessing performance.

Why Percentages Paint a Clearer Picture

Imagine your business achieves an operating profit of £50,000. This initially seems positive. However, if your revenue is £1,000,000, this represents an operating profit margin of only 5%. Consider another business with a lower operating profit of £40,000. But, if their revenue is only £200,000, their margin is a much healthier 20%. In the UK, operating profit margin is a key metric for evaluating a company’s efficiency. It's calculated by dividing operating profit by total revenue. For example, a UK company with an operating profit of £150,000 on revenue of £500,000 has a 30% operating profit margin. This means 30 pence of every pound earned remains after operating expenses. Maintaining a healthy operating profit margin is vital for long-term sustainability and competitiveness. UK businesses often benchmark their performance against industry averages. Investopedia offers further information on operating profit.

Benchmarking Against Your Industry

Different industries have different profit margin expectations. Supermarkets, for instance, often operate with lower margins due to high sales volume. In contrast, software companies typically command higher margins due to lower production costs and recurring revenue. Comparing your margin against relevant industry benchmarks is essential to truly understand your performance. This comparison is particularly important for TikTok Shop sellers, as the platform’s competitive landscape demands efficient cost management and strategic pricing.

The data chart below visualizes average operating profit margins across various sectors, highlighting the difference between top and bottom performers.

This data chart illustrates the importance of understanding where your business stands in the competitive landscape. For example, it might reveal that the average operating profit margin for online retailers is 10%, with top performers achieving 15% or more, while struggling businesses fall below 5%. This information helps pinpoint potential areas for improvement. Using a tool like Mergoio can provide granular data for calculating and tracking your operating profit margin, leading to more informed decisions.

To further illustrate industry benchmarks, let's examine some average operating profit margins:

Average Operating Profit Margins by Industry

| Industry Sector | Average Operating Profit Margin (%) | Top Performer Range (%) | Bottom Performer Range (%) |

|---|---|---|---|

| Software | 20 | 30 | 10 |

| Online Retail | 10 | 15 | 5 |

| Supermarkets | 3 | 5 | 1 |

| Automotive | 8 | 12 | 4 |

This table highlights the significant variations in profitability across different sectors. Software companies typically enjoy higher margins, while supermarkets operate on much thinner margins. Understanding these benchmarks allows you to assess your own performance within the context of your industry.

Identifying Trends and Setting Realistic Targets

Analyzing your operating profit margin trends over time can reveal early warning signs. A consistently declining margin might indicate rising costs, increased competition, or pricing pressures. Recognizing these trends early allows for proactive measures. Benchmarking helps set realistic targets for margin improvement. Aiming for a margin within your industry's top performer range provides a tangible goal and motivates operational efficiency. Mergoio's forecasting capabilities can assist in setting realistic profit margin targets, aligning your pricing and cost management for maximum profitability on TikTok Shop.

Beyond the Basics: Operating Result Vs. Other Metrics

While operating profit offers valuable insights into your core business performance, it isn't the only profit metric worth considering. Other key figures, such as gross profit, net profit, and EBITDA, provide unique perspectives on your company's financial well-being. Understanding the differences between these metrics is crucial for sound decision-making. This section explores when each metric offers the most relevant information.

Gross Profit: Your First Profit Checkpoint

Before reaching your operating profit, you'll calculate your gross profit. This metric represents the profit remaining after deducting the direct costs of producing your goods or services (Cost of Goods Sold – COGS) from your revenue. This initial profit calculation helps assess the profitability of your offerings before factoring in overhead and operational expenses. For instance, if a UK clothing retailer sells a dress for £60 and the COGS (material, labor) is £25, the gross profit on that dress is £35.

Operating Profit: A Closer Look at Core Operations

Building on gross profit, operating profit subtracts your business's running costs, such as salaries, marketing, and rent. These operating expenses are essential for daily operations but aren't directly tied to producing individual products. This refined metric helps identify inefficiencies within your operations. For example, a high gross profit margin could be offset by excessive operating expenses, leading to a lower operating profit.

Net Profit: The Bottom Line

Net profit represents your final profit after all expenses, including interest and taxes, have been deducted. This is the true "bottom line," demonstrating your company's overall profitability. While important for investors and financial reporting, net profit can sometimes obscure the efficiency of your core operations. High interest payments on loans, for instance, might significantly reduce net profit even with strong operating performance.

EBITDA: A Different Perspective on Profitability

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) offers another viewpoint. By excluding non-cash items like depreciation, it provides a clearer picture of your cash flow from operations. This is particularly helpful when comparing businesses with different capital structures or evaluating a company's ability to service debt. For example, two businesses with similar operating profits might have significantly different EBITDA figures due to variations in depreciation expenses.

Using Metrics Strategically

The most suitable metric depends on your specific needs. When assessing operational efficiency, operating profit provides focused insights. For investor communication, net profit is typically the primary focus. When applying for a business loan, banks may prioritize EBITDA to gauge your repayment ability. Learn more in our article about mastering your TikTok shop financials. Effective business owners use a combination of these metrics to gain a comprehensive understanding of their financial performance and make informed strategic decisions. A high operating profit coupled with a declining net profit, for example, could indicate debt management issues, prompting you to explore refinancing options. By understanding the nuances of each profit metric, you can gain a deeper insight into your business's financial strength and pinpoint opportunities for growth and improvement.

Economic Headwinds: Protecting Your Operating Results

Your carefully calculated operating result, derived from the operating result formula, faces constant pressure from external economic forces. The UK's economic environment, with its inherent inflation and interest rate fluctuations, can directly impact your business' performance. Understanding these broader economic factors is as crucial as understanding the formula itself. This section explores how these conditions can influence your operating results and offers strategies to navigate these challenges.

The Impact of Inflation on Operating Expenses

Inflation can significantly affect your operating expenses. Rising energy prices can quickly inflate utility costs, while increases in raw material costs impact your cost of goods sold (COGS). Not all expenses are affected equally by inflation. You need to analyze how inflation uniquely impacts your specific cost categories.

Understanding these nuances allows you to anticipate potential problems and adjust your pricing or sourcing strategies. This proactive approach is essential for protecting your operating profit margin.

Navigating Interest Rate Fluctuations

Interest rate fluctuations present another set of challenges. If your business relies on borrowing, rising interest rates increase your financing costs, directly impacting your bottom line. Periods of rising rates can significantly erode operating profit. Conversely, lower interest rates can create opportunities for investment and expansion.

Carefully monitoring interest rate trends and adjusting your financial strategy is essential for a healthy operating result. This foresight can help you capitalize on favorable economic conditions.

The Silent Erosion of Currency Movements

Currency fluctuations also play a significant role, particularly for businesses engaged in international trade. If the value of the pound sterling declines against other currencies, the cost of imported goods and services increases. This can squeeze profit margins if you're unable to pass these increased costs onto your customers.

Understanding how currency movements affect your business is particularly important in the UK's globally connected economy. Staying informed about currency trends helps you anticipate potential issues and implement appropriate hedging strategies to mitigate risk.

The Influence of Broader Economic Indicators

The concept of operating profit is closely tied to broader economic indicators like inflation and GDP in the UK. Inflation, which can be measured using the Bank of England's inflation calculator, impacts both revenue and operating expenses. For instance, significant inflation increases your COGS and other expenses, potentially reducing operating profit. Historically, periods of high inflation have presented difficulties for UK businesses. Analyzing these economic trends is crucial for adapting financial strategies and ensuring sustainable growth.

Building Resilience in Uncertain Times

Successfully navigating economic headwinds requires a proactive and adaptable approach. Businesses that thrive in challenging economic climates prioritize careful financial planning, robust cost management, and a strong understanding of market dynamics. For example, efficient inventory management minimizes storage costs and reduces waste, protecting your operating profit from the effects of inflation on warehousing expenses.

Diversifying your supplier base can mitigate risks associated with supply chain disruptions and currency fluctuations. Using tools like Mergoio for detailed tracking and forecasting provides data-driven insights to make informed decisions and maintain a healthy operating result amidst economic uncertainty.

Transform Your Operating Results: Proven Strategies

This section offers actionable strategies to boost your operating results, moving beyond simply understanding the operating result formula. We'll delve into insights from successful business leaders, exploring techniques applicable to diverse business models and growth stages.

Optimizing Your Expense Categories

Improving operating results often starts with expense optimization. This isn't about indiscriminate cost-cutting, which can negatively impact quality and customer satisfaction. Instead, it's about strategically pinpointing areas for reduction without compromising your core offerings.

-

Negotiate with Suppliers: Review your current supplier contracts and explore opportunities for improved terms. Even small discounts can lead to significant overall savings.

-

Streamline Operations: Identify and eliminate workflow inefficiencies. Automating repetitive tasks can free up valuable staff time and resources. For TikTok Shop sellers, tools like Mergoio can automate tasks such as affiliate payment reconciliation and sales tracking.

-

Review Marketing Spend: Analyze your marketing campaigns' effectiveness. Prioritize channels with the highest return on investment and reduce spending on underperforming strategies.

Revenue Enhancement Techniques

While expense optimization is crucial, boosting revenue presents even greater potential for improving operating results. This involves leveraging existing operations for maximum efficiency.

-

Upselling and Cross-selling: Encourage customers to purchase higher-value products or related items. This increases average order value, directly boosting revenue.

-

Pricing Strategies: Review your pricing structure and consider strategic adjustments. Even small increases, if justified by value, can substantially impact profit.

-

Customer Retention: Focus on retaining existing customers. It's typically more cost-effective to retain a customer than acquire a new one. Loyal customers tend to spend more over time.

The Power of Digital Transformation

Digital transformation initiatives can substantially improve operating results. Automating tasks, streamlining workflows, and gaining data-driven insights are just some of the ways technology can enhance efficiency and profitability.

-

Inventory Management: Implement software to optimize inventory levels, minimizing storage costs and reducing waste.

-

Data Analytics: Leverage data to understand customer behavior and identify growth opportunities. Mergoio, for example, provides TikTok Shop sellers with detailed analytics on sales, cancellations, and affiliate performance.

-

Automation: Automate repetitive tasks, such as order processing and customer support, allowing staff to focus on higher-value activities.

Evaluating Operational Investments

Not all investments are created equal. When considering operational investments, evaluate their potential return. Will a new software platform streamline workflows enough to justify its cost? Will a new marketing campaign generate enough leads to offset its expenses? You might be interested in: How to master… using Mergoio.

By carefully assessing investments and prioritizing those with the highest potential returns, you can maximize operating results and ensure long-term success. This is especially relevant for TikTok Shop sellers operating in a competitive landscape. Mergoio's real-time analytics can inform these decisions, ensuring effective resource allocation. Its detailed tracking and forecasting features offer the insights needed to optimize pricing, manage costs, and ultimately boost operating profits.

Avoid These Operating Result Formula Pitfalls

Even seasoned financial professionals can sometimes struggle with calculating and interpreting operating results. This section highlights common—and potentially costly—mistakes businesses make and offers practical solutions to ensure your calculations stay accurate and insightful.

Inconsistent Expense Classification: A Recipe for Distortion

One frequent pitfall is inconsistent expense classification. Imagine accidentally categorizing marketing campaign costs as administrative expenses one month, then correctly classifying them as marketing expenses the next. This creates a distorted view of your performance trends. Your administrative expenses will appear inflated one month, while marketing expenses seem unusually low the next, making it difficult to analyze spending patterns accurately. Maintaining standardized expense categorization is key for accurate trend analysis.

Calendar-Based Analysis: Misleading Seasonal Businesses

Analyzing data solely on a calendar-year basis can be misleading, particularly for seasonal businesses. Directly comparing January's operating results with December's for a Christmas decoration shop, for example, is inherently flawed. December, a peak sales month, will naturally have higher revenue and expenses. Year-over-year comparisons within the same month are much more informative for seasonal businesses. Comparing December 2023 with December 2022 provides a more accurate performance assessment.

Focusing on the Wrong Benchmarks: A Strategic Misstep

Comparing your operating profit margin to the wrong benchmarks can lead to poor strategic decisions. A small, independent bookshop shouldn't compare its margins to a large online retailer like Amazon. Their business models, cost structures, and pricing strategies are vastly different. Focus on relevant competitors or industry-specific averages for a more meaningful performance assessment. This targeted benchmarking offers more actionable insights.

Accounting Practices That Cause Confusion: Depreciation and Amortization

Depreciation and amortization, while essential for accurate accounting, can sometimes cause confusion when analyzing operating results. These non-cash expenses reflect the decrease in an asset’s value over time. They don’t represent a current cash outflow. This distinction is important for understanding the difference between cash flow and profitability. A high depreciation expense might lower your operating profit, but it doesn't necessarily impact your immediate cash position.

Verification Checklist for Accurate Calculations

To avoid these pitfalls, use this checklist:

-

Consistent Expense Classification: Ensure consistent expense categorization across all reporting periods. Implement a detailed chart of accounts and train your team on proper classification.

-

Seasonal Adjustments: For seasonal businesses, compare results year-over-year within the same month. Consider using rolling averages or other smoothing techniques.

-

Relevant Benchmarks: Select benchmarks appropriate for your business size, industry, and target market.

-

Understand Non-Cash Expenses: Understand how depreciation and amortization affect your operating results. Analyze both profitability and cash flow metrics.

By following these guidelines, you can ensure the accuracy and relevance of your operating result calculations, enabling you to make informed, data-driven decisions. Optimize your TikTok Shop business with Mergoio for better financial control.

Leave a Reply